The government has learned from economic disaster, embraced high-skilled immigrants, played venture capitalist, and imported one heck of a good central banker.

(Reuters)

In case it wasn’t clear the first time he said it, Mitt Romney is certain that “culture” is the reason Israelis are relatively rich today, while Palestinians are quite poor. Much of the world — including the authors Romney cited — responded to his analysis with a collective “oy.”

But Romney’s stand does raise a few good questions. Among them: How on earth has Israel become so successful? Sure, its economy has no shortage of problems — in particular, a startling degree of income inequality. But in the span of just a few decades, the Jewish state has “transformed itself from a semisocialist backwater into a high-tech superpower,” as TheEconomist put it in 2010. Per capita, it gives birth to more technology startups and is the destination for more venture capital than any other country is the world. Its economy barely flinched during the financial crisis.

Here are four big reasons (though by no means the only ones) Israel is in the strong shape it is today.

IT LEARNED FROM DISASTER

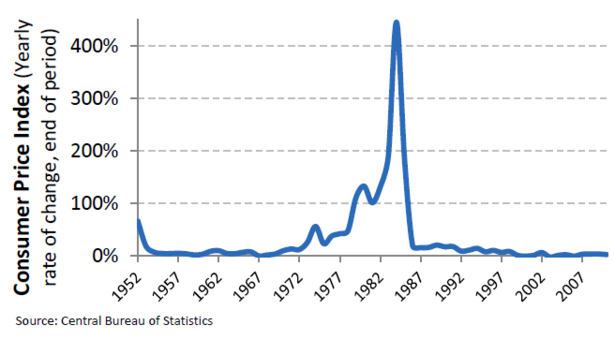

It may now be known as the Silicon Valley of the Middle East, but back in 1984, Israel’s story had much more in common with modern-day Zimbabwe. That year, the inflation rate averaged 450 percent, and for a few months reached vertigo-inducing highs of around 950 percent. The economy, in short, was eating itself alive. But the crisis had an upside, in that it sparked reforms that would lay the groundwork for Israel’s present-day prosperity.

Like any nasty bout of hyperinflation, this one had a few culprits. But here’s the streamlined version of what happened: Starting with the massive military buildup that followed the 1973 Yom Kippur war, Israel began ratcheting up its public sector spending. By the end of the decade, the government was consuming three quarters of the economy and leaving behind huge budget deficits, which it tried to finance by having the Bank of Israel print money. The fact that Israeli workers’ wages rose with the cost of living only made the situation worse.

Fighting severe inflation usually means suffering through some unemployment, and so Israeli policy makers, who were obsessively focused on providing the country with jobs, did little to fix their metastasizing problem. But as the economy’s health deteriorated — on top of the inflation problem, there was a banking crisis — investors began evacuating their money from the country, and it became unclear if Israel would be able to pay its foreign debts. In 1985, government leaders met for a marathon, one-day summit where they crafted a grand bargain that slashed government spending, massively devalued the currency, and severed the tie between wages and prices. It also set new rules for a more independent central bank.

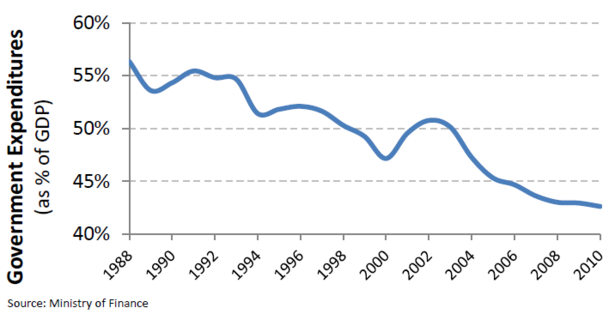

This was, in many ways, the beginning of the modern Israeli economy, a step away from the early workers’ state, and towards something more akin to mainline modern capitalism. Although public spending in Israel is still high, the government has gradually eased up its role in the economy, while focusing on keeping inflation low and its deficits manageable.

IT WELCOMED BRILLIANT IMMIGRANTS

Israel’s economy started getting healthy when the government started practicing mainstream economics. But it also benefited from a once-in-a-century stroke of luck. When the Soviet Union began to collapse, American immigration policy prevented a large number of Russian Jews from coming to the United States. Instead, they chose Israel. Between 1990 and 1997, more than 710,000 Soviet immigrants landed in the country, boosting the working age population by 15 percent. Around 60 percent of the new arrivals had a college education, versus 30 to 40 percent of the native population. Immigration, in general, is good for growth. There are more people to work, buy houses, shop at malls, and pay taxes. When those immigrants are engineers, managers, and college professors, it’s even better for growth. The Russian influx gave Israel a booster shot of both bodies and brains.

THE GOVERNMENT PLAYED VENTURE CAPITALIST (BRIEFLY)

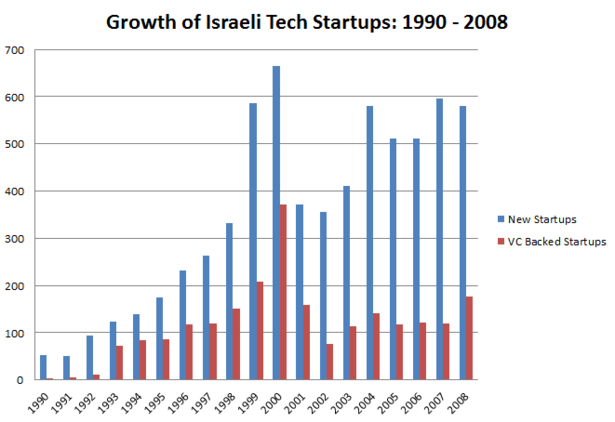

These days, you’ll often hear Israel referred to as “the start-up nation.” The nickname comes from the title of a book co-authored by Romney adviser Dan Senor, which argues that the country’s brash, ambitious culture, and its citizens’ ability to overcome adversity, is the secret to its success as a high-tech incubator. The Washington Post’s Zach Goldfarb has dubbed this theory the “chutzpah thesis.”

And chutzpah is probably part of it. But early on, so was the helping hand of government. Thanks partly to investments in military research and its well-educated population, Israel had some of the key ingredients for a high-tech boom by the early 1990s. But it lacked an important catalyst: investors. As Glenn Yago, senior director at the Milken Institute’s Israel Center, told me, there was virtually no venture capital scene in Israel to speak of. Rather, the economy was still dominated by state-backed behemoths. “Basically, it was a kind of crony capitalism,” he said.

That began to change with the Yozma program, a $100 million state-owned venture capital fund that opened for business in 1993. Some of the money was invested directly in startups. But more importantly, the program convinced foreign venture capitalists to create funds in Israel by lowering their taxes and promising to match part of the money they raised from investors. In doing so, it set in motion a virtuous cycle that created a thriving, independent venture capital market that was backing hundreds of startups a year by 2000, as shown in the graph below, adapted from a paper by Israeli researcher Gil Avnimelech. With the market up and running, the government privatized Yozma in 1998.

As George Gilder wrote in City Journal, it took a final, massive round of deregulation under Prime Minister Benjamin Netanyahu in 2005 before Israel would have a full-fledged financial services industry. But Israel pulled off a remarkable feat by cleverly growing a financial ecosystem for its tech entrepreneurs from scratch.

THEY MAY HAVE THE WORLD’S SMARTEST CENTRAL BANKER

There are a host of reasons Israel managed to escape the worst of the global financial crisis and its awful aftermath. For one, it managed to properly implement something close to a classic Keynesian spending policy, cutting its deficit during the good times before the meltdown, then letting it grow when the economy went south.

But the country also has a not-so-secret weapon: Stanley Fischer, the Zambian-born, U.S. educated head of the Bank of Israel. A former MIT professor, chief economist at the World Bank, deputy managing director at the International Monetary Fund, and vice chairman at Citigroup, Fischer was not an Israeli citizen when he was recruited to manage the country’s monetary policy. He was an import. But since taking the helm in 2005, he’s managed to keep the country’s currency relatively stable against a fluctuating dollar — key for their exports — while steering the economy towards consistent growth.

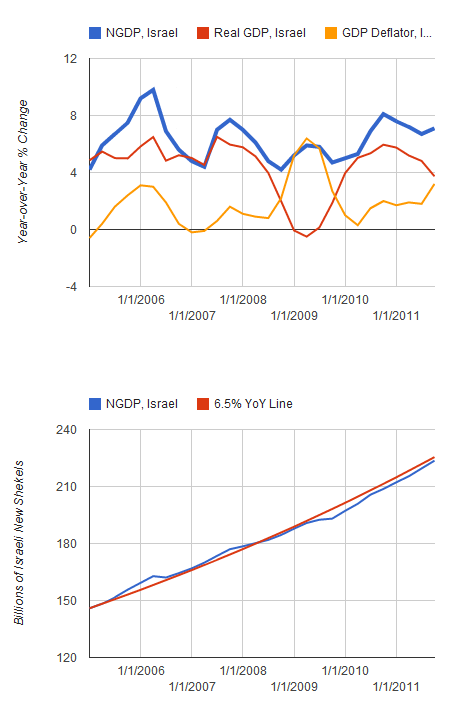

In a much discussed blog post, Evan Soltas pointed out that this growth may have been the product of a controversial strategy known as “nominal GDP targeting,” where a central bank picks an annual growth figure, and tries to hit it whether through inflation, or by expanding the real economy. The idea is to prevent private debts from crashing the economy by making sure incomes steadily rise, even if real growth slows down a bit.

As Soltas’ graphs below show, Israel’s real GDP and inflation have moved in opposite directions, while its nominal GDP has hovered right around 6.5 percent per year.

This is a strategy that many, including The Atlantic‘s Matt O’Brien, have hoped the Fed would pursue to rev up our own economy. But as of now, that seems like a remote possibility.

MORE THAN CULTURE

So in a sense, Romney had a point. Culture has been a big factor in Israel’s success. Its openness to immigrants and the ingenuity of its entrepreneurs have played a role in its economic renaissance. But unless you lump your feelings about about government spending as a percentage of GDP, public-private partnerships, and NGDP targeting under the header of culture – and who knows, you might – then that’s only part of the explanation. Rather, Israel’s government has gotten better over time at learning when it needs to get out of the way, and knowing when it needs to step in and lend the private economy a hand, when it needs to tackle a problem like inflation, and when a little bit could be good for growth. It’s figured out how to be flexible. That’s a lesson some of our own policy makers could probably use, too.

This article available online at:

http://www.theatlantic.com/business/archive/2012/08/its-not-just-the-culture-stupid-4-reasons-why-israels-economy-is-so-strong/260610/